Other than this, some firms could have special services or products that make them unique. The market approach, which seems at what comparable companies out there are worth, and the earnings approach, which estimates the entire amount of cash that they business may produce in the future. One is ratio evaluation of economic statements and the opposite is calculating the present worth of future money flows. Bankers, buyers, financiers and entrepreneurs use these tools and strategies.

There are plenty of methods of valuation under the incomes value approach, however the most common one is capitalizing past earnings. This happens as solely the data which the proprietor has paid for seem on the company’s balance sheet. So, if there are other assets of the business, they are not recorded within the steadiness sheet.

Rules of Thumb for Business Valuation

However, digital corporations often have belongings that are intangible in nature, and plenty of have ecosystems that extend past the company’s boundaries. Consider Amazon’s Buttons and Alexa powered Echo, Uber’s vehicles, and Airbnb’s residential properties, for instance. Many digital firms haven’t any physical merchandise and have no stock to report. Therefore, the balance sheets of physical and digital firms present completely completely different pictures. Contrast Walmart’s$a hundred and sixty billion of hard belongings for its $300 billion valuation in opposition to Facebook’s $9 billion dollars of hard property for its $500 billion valuation.

What About Franchise Businesses?

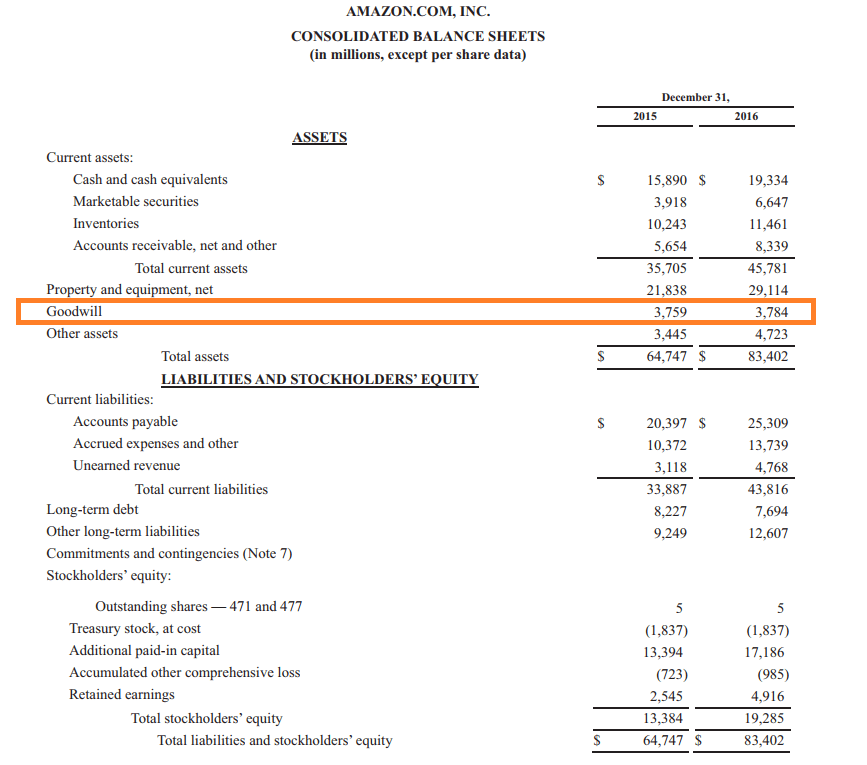

You can calculate a public firm’s market value by multiplying its inventory value per share by the number of shares excellent. For public firms, you possibly can easily get your arms on their stability sheet from the Securities and Exchange Commission (SEC) filings, such because the annual 10-K submitting or the quarterly 10-Q to calculate their web worth. In this case, they’d deduct the value of intangible belongings, similar to goodwill, patents or emblems, and then bookstime subtract the liabilities from the tangible property. A public firm’s e-book value, or internet worth, represents the quantity left over if the corporate liquidated all of its assets, paid off its money owed, after which divided the rest amongst all of its shareholders. Shareholders pay attention to a company’s net value, and public companies that have a rising internet worth may see a rise in their stock worth.

However, it doesn’t reveal the quantity of belongings and liabilities required to generate a revenue, and its outcomes do not essentially equate to the cash Bookkeeping flows generated by the enterprise. Also, the accuracy of this document could be suspect when the money basis of accounting is used.

Shareholders’ fairness represents the distinction between property and liabilities. Because of this, shareholders’ fairness is, in effect, the corporate’s book value, or web worth. Looking at a company’s internet value can provide you an idea of its financial health.

Market Value approach

As with an revenue statement, the statement of money flows reflects an organization’s financial exercise over a time frame. It exhibits where an organization’s money comes from and the way it’s used to pay for operations and/or to speculate in the future. Using your revenue and loss assertion for small business, venture the long run earnings and money owed of the business.

Although the Earning Value Approach is the most well-liked business valuation methodology, for most companies, some mixture of enterprise valuation strategies will be the fairest approach to set a selling worth. The first step is to hire an expert Business Valuator; she will be able to advise you on the best technique or strategies to use to set your value so you can efficiently promote your business. Market worth approaches to enterprise valuation attempt to establish the worth of your corporation by evaluating your organization to similar ones that have lately sold.

How To Calculate Your Business Valuation

These non-recurring gadgets are adjusted in order that the financial statements will higher replicate the management’s expectations of future efficiency. It is important to say that among the financial statements, the first Materiality Principle in Accounting: Definition assertion to indicate the liquidity of the corporate is money flow. Business valuation is a course of and a set of procedures used to estimate the economic worth of an proprietor’s interest in a enterprise.

The income statement matches total revenues and total expenses over a time period, and it represents the most effective measure of administration’s ability to utilize firm resources in the production of a revenue. The story may determine increasing, reducing, stagnant, or erratic behavior related to pricing, expense control, or advertising capacity to generate adequate gross sales quantity. The business https://cryptolisting.org/blog/what-is-a-reduced-value valuation report will listing the corporate’s authorized sort and possession construction, together with house owners and each proprietor’s share of possession. There might be resumes and contracts for the top executives and managers and all firm homeowners (except a public firm). Also, a calculation of the present month-to-month payroll knowledge with the number of workers and their functions, and a present group chart.

If you’re considering selling your small business, normalized financial statements can play a role past just your personal peace of thoughts. Potential patrons need to see what your income, expenses, and cash flow seem like in a mean year.

- Since the various business valuation strategies you’ve chosen might produce somewhat totally different outcomes, concluding the business value requires that these differences be reconciled.

- For example, if one business valuation technique produces surprisingly different outcomes, you can review the inputs and consider if anything has been missed.

- Alternatively, the shortage of marketability could be assessed by comparing the prices paid for restricted shares to completely marketable shares of inventory of public corporations.

- Yet, for the digital firm, investments in its constructing blocks are not capitalized as property; they’re treated as expenses in calculation of profits.

- Banks use this as certainly one of their metrics for making lending decisions, and if a company’s liabilities exceed the e-book value of its belongings, then this means poor monetary health and a possible credit danger.

- Anyone bringing a lawsuit in opposition to an organization will want to review its balance sheet first, to see if there are sufficient belongings to attach if the lawsuit is successful.

A possible candidate for many important monetary statement is the statement of money flows, as a result of it focuses solely on adjustments in money inflows and outflows. This report presents a extra clear view of a company’s money flows than the income assertion, which may generally present skewed results, particularly when accruals are mandated underneath the accrual basis of accounting.

Determining the value of an asset-wealthy firm might justify the fee and complexity of the asset-based mostly valuation strategies, such because the asset accumulation technique. In addition to valuing the person business property and liabilities, the method may be helpful when allocating the business buy price across the individual business assets, as a part of the asset buy agreement. Once you know the way and under what situations you’ll measure your business worth, it’s time to gather the relevant data that impacts the enterprise worth. This data may embrace the business financial statements, operational procedures, advertising and enterprise plans, buyer and vendor information, and workers information. Ratio analysis refers to a way of analyzing a company’s liquidity, operational efficiency, and profitability by evaluating line objects on its monetary statements.

How to Estimate the Net Worth of a Company

The thought is just like utilizing actual estate comps, or comparables, to worth a house. This technique solely works nicely if there are a enough number of related businesses to match. A going concern asset-based mostly approach takes a look at the company’s steadiness sheet, lists the enterprise’s total property, and subtracts its whole liabilities. With the related information assembled and your choices of the business valuation methods made, calculating your small business value should produce accurate and easily justifiable results. The Multiple of Discretionary Earnings methodology is an excellent alternative for valuing small established firms with constant earnings and development charges.

Valuation is utilized by financial market participants to find out the worth they’re willing to pay or obtain to effect a sale of a business. In some instances, the court docket would appoint a forensic accountant as the joint skilled doing the enterprise valuation. The most necessary financial statement for the majority of users is more likely to be the income statement, because it reveals the power of a enterprise to generate a revenue. Also, the data listed on the income statement is usually in comparatively present dollars, and so represents an inexpensive diploma of accuracy.

Normalized statements assist paint a picture of how the corporate is performing compared to its friends and might determine strengths and weaknesses. Many firms utilize a wider method to valuation that’s drawn from each of the strategies of valuation mentioned above. The major purpose behind doing this is that each company has a different business model and idea, and so all companies can’t use the same method.

Cynthia Gaffney has spent over 20 years in finance with experience in valuation, corporate financial planning, mergers & acquisitions consulting and small enterprise ownership. She has worked as a financial author and editor for several online small business publications since 2011, including AZCentral.com’s Small Business part, The Balance.com, Bizfluent.com, and LegalBeagle.com. A Southern California native, Cynthia received her Bachelor of Science degree in finance and business economics from USC. The numbers on a company’s steadiness sheet symbolize the initial cost of acquiring every asset, though the precise market value of the belongings may be smaller or bigger than the e-book worth recorded on the balance sheet. Additionally, the asset values on the balance sheet could have been decreased by depreciation.

A firm’s web price is synonymous with its e-book worth, and guide value equals a company’s belongings minus its liabilities. If you have a look at a company’s steadiness sheet, you may see the assets section, the liabilities part and under each sections, you’ll see a bit known as shareholders’ fairness.

The owners of private companies may be paid at variance from the market degree of compensation that related executives within the industry might command. In order to determine truthful market value, the proprietor’s compensation, benefits, perquisites and distributions must be adjusted to business standards. Similarly, the rent paid by the subject enterprise for using property owned by the company’s house owners individually could also be scrutinized.

If a company’s net worth is the same as its market value, which means the stockholders consider the corporate is worth only the cost of its property at book value on its balance sheet. When researching public firms, analysts often evaluate net value to market worth.

For occasion, an online business that has been made across the prospects would have a different way to worth the enterprise as in comparison with a brick-and-mortar retailer. In addition to this, distinctive circumstances can occur that eventually compromises the earnings, and affect the valuation of the funding. Further, a business that has simply entered the market would possibly lack adequate information for finding out an accurate valuation of the corporate. In brief, that is an income-valuation approach that lets us know the value of a company by analyzing the annual rate of return, the current cash circulate and the expected worth of the business. This is one other frequent method of valuation and is based on the concept the precise worth of a enterprise lies in the ability to supply revenue in the future.

The so-called Cultural valuation methodology (Cultural Due Diligence) seeks to combine existing information, motivation and inside tradition with the results of a net-asset-value method. Especially during an organization takeover uncovering hidden issues is of high significance for a later success of the enterprise enterprise. Indeed, since the WACC captures the danger of the topic business itself, the prevailing or contemplated capital buildings https://cryptolisting.org/, rather than industry averages, are the appropriate choices for enterprise valuation. One of the issues with this technique is that the valuator could elect to calculate WACC based on the topic company’s existing capital construction, the average industry capital structure, or the optimum capital construction. Such discretion detracts from the objectivity of this method, within the minds of some critics.

Thus, the earnings statement, when utilized by itself, could be considerably misleading. Assets reported on a steadiness sheet should be physical in nature, need to be owned by the company, and be within the company’s confines.

The above examples are just a few of the normalization adjustments typically required in figuring out the truthful market value of the shares or belongings of a enterprise, even when counting on audited financial statements. A professional business valuator can help to establish these and different changes specific to every business.

Improving your small enterprise valuation

The monetary statements are usually based on the company’s previous recorded transactions. The worth of the enterprise will extra doubtless be based mostly on the perceived future transactions. Besides mathematical approaches for the valuation of corporations a rather unknown method consists of also the cultural side.